투자정보

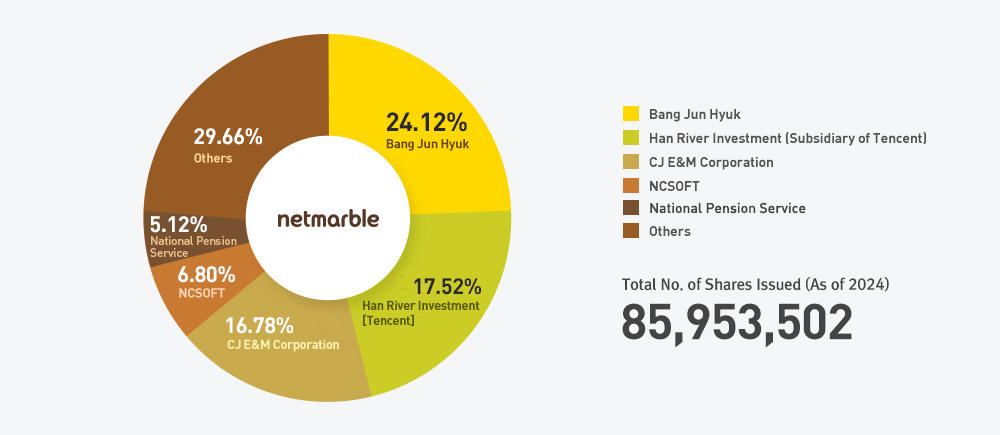

Ownership Structure

As of December 31, 2024

| Major Shareholders | No. of Common Shares | Ownership (%) |

|---|

Shareholder’s Meeting

| 14th Annual General Shareholder’s Meeting | |||

|---|---|---|---|

| Overview | Date | Monday, March 31, 2025 at 9:00 AM (Local time) | |

| Place | G-Tower Convention(2F), G-Tower, 38 Digital-ro 26-gil, Guro-gu, Seoul, Korea | ||

| Exercise of Voting Rights (Unit : 1 share) |

Total Issued Shares | 85,953,502 | |

| Shares with Voting Rights | 81,934,571 | ||

| Shares with Voting Rights Exercised | 70,057,333 | ||

| Ratio of Shares with Voting Rights Exercised to Total Issued Shares Excluding Largest Shareholders | 60.1% | ||

| Results | Agenda | Approval rate | |

| No.1 | Approval of the 14th financial statements | 98.82% | |

| No.2 | Partial amendment to the articles of incorporation | 99.96% | |

| No.3 | Approval of the Appointment of Directors | - | |

| No.3-1 | Appointment of an Executive Director(Gi-Uk Do) | 96.89% | |

| No.3-2 | Appointment of an Non-executive Director(Nachuan Li) | 93.87% | |

| No.3-3 | Appointment of an Outside Director(Chan-hee Lee) | 99.40% | |

| No.4 | Appointment of an Outside Director who will become a Member of the Audit Committee(Yi Kang) |

97.74% | |

| No.5 | Appointment of Audit Committee Member(Chan-hee Lee) | 98.29% | |

| No.6 | Approval of Director Remuneration Limit | 93.68% | |

| 13th Annual General Shareholder’s Meeting | |||

|---|---|---|---|

| Overview | Date | Thursday, March 28, 2024 at 9:00 AM (Local time) | |

| Place | G-Tower Convention(2F), G-Tower, 38 Digital-ro 26-gil, Guro-gu, Seoul, Korea | ||

| Exercise of Voting Rights (Unit : 1 share) |

Total Issued Shares | 85,953,502 | |

| Shares with Voting Rights | 81,934,571 | ||

| Shares with Voting Rights Exercised | 69,621,493 | ||

| Ratio of Shares with Voting Rights Exercised to Total Issued Shares Excluding Largest Shareholders | 59.7% | ||

| Results | Agenda | Approval rate | |

| No.1 | Approval of the 13th financial statements | 99.88% | |

| No.2 | Partial amendment to the articles of incorporation | 99.95% | |

| No.3 | Approval of the Appointment of Directors (Inside director Kim Byung Guy) | 99.65% | |

| No.4 | Approval of Director Remuneration Limit | 99.95% | |

| 12th Annual General Shareholder’s Meeting | |||

|---|---|---|---|

| Overview | Date | Wednesday, March 29, 2023 at 9:00 AM (Local time) | |

| Place | G-Tower Convention(2F), G-Tower, 38 Digital-ro 26-gil, Guro-gu, Seoul, Korea | ||

| Exercise of Voting Rights (Unit : 1 share) |

Total Issued Shares | 85,953,502 | |

| Shares with Voting Rights | 81,934,571 | ||

| Shares with Voting Rights Exercised | 68,247,240 | ||

| Ratio of Shares with Voting Rights Exercised to Total Issued Shares Excluding Largest Shareholders | 57.9% | ||

| Results | Agenda | Approval rate | |

| No.1 | Approval of the 12th financial statements | 98.89% | |

| No.2 | Partial amendment to the articles of incorporation | 100.00% | |

| No.3 | Approval of the Appointment of Directors | - | |

| No.3-1 | Appointment of an Executive Director (Jun-Hyuk Bang) | 99.42% | |

| No.3-2 | Appointment of an Executive Director (Young-Sig Kwon) | 99.88% | |

| No.3-3 | Appointment of an Executive Director (Gi-Uk Do) | 99.88% | |

| No.3-4 | Appointment of a Non-executive Director (Piao Yanli) | 99.32% | |

| No.3-5 | Appointment of an Outside Director (Dae-Gyun Yoon) | 99.96% | |

| No.3-6 | Appointment of an Outside Director (Dong-Heon Lee) | 99.96% | |

| No.3-7 | Appointment of an Outside Director (Deuk-Soo Hwang) | 92.25% | |

| No.4 | Appointment of members of the Audit Committee | - | |

| No.4-1 | Appointment of an Audit Committee member (Dae-Gyun Yoon) | 99.83% | |

| No.4-2 | Appointment of an Audit Committee member (Dong-Heon Lee) | 99.83% | |

| No.4-3 | Appointment of an Audit Committee member (Deuk-Soo Hwang) | 78.11% | |

| No.5 | Approval of Director Remuneration Limit | 99.75% | |

| 11th Annual General Shareholder’s Meeting | |||

|---|---|---|---|

| Overview | Date | Tuesday, March 29, 2022 at 9:00 AM (Local time) | |

| Place | G-Tower Convention(2F), G-Tower, 38 Digital-ro 26-gil, Guro-gu, Seoul, Korea | ||

| Exercise of Voting Rights (Unit : 1 share) |

Total Issued Shares | 85,953,502 | |

| Shares with Voting Rights | 81,934,571 | ||

| Shares with Voting Rights Exercised | 69,468,352 | ||

| Ratio of Shares with Voting Rights Exercised to Total Issued Shares Excluding Largest Shareholders | 59.5% | ||

| Results | Agenda | Approval rate | |

| No.1 | Approval of the 11th financial statements | 98.60% | |

| No.2 | Appointment of Outside Directors | - | |

| No.2-1 | Appointment of an Outside Director (Joon-hyun Kim) | 92.95% | |

| No.2-2 | Appointment of an Outside Director (Chan-hee Lee) | 99.38% | |

| No.3 | Appointment of an Outside Director who will become a member of the Audit Committee (Sung-ryul Jeon) | 99.94% | |

| No.4 | Appointment of members of the Audit Committee | - | |

| No.4-1 | Appointment of an Audit Committee member (Joon-hyun Kim) | 82.98% | |

| No.4-2 | Appointment of an Audit Committee member (Chan-hee Lee) | 97.47% | |

| No.5 | Approval of Director Remuneration Limit | 93.14% | |

| No.6 | Approval of the rules for the payment of severance pay for executives | 99.99% | |

| 10th Annual General Shareholder’s Meeting | |||

|---|---|---|---|

| Overview | Date | Friday, March 26, 2021 at 9:00 AM (Local time) | |

| Place | G-valley Convention(1F), G-valley Biz Plaza, 300 Digital-ro, Guro-gu, Seoul, Korea | ||

| Exercise of Voting Rights (Unit : 1 share) |

Total Issued Shares | 85,845,303 | |

| Shares with Voting Rights | 81,826,372 | ||

| Shares with Voting Rights Exercised | 69,010,661 | ||

| Ratio of Shares with Voting Rights Exercised to Total Issued Shares Excluding Largest Shareholders | 59.0% | ||

| Results | Agenda | Approval rate | |

| No.1 | Approval of the 10th financial statements | 98.67% | |

| No.2 | Partial amendment to the articles of incorporation | 100.00% | |

| No.3 | Approval of Director Remuneration Limit | 92.30% | |

| No.4 | Approval of the rules for the payment of severance pay for executives | 99.99% | |

Shareholder Return

| Category | 2024 | 2023 | 2022 | 2021 | 2020 | |

|---|---|---|---|---|---|---|

| Cash Dividends |

Total payout (KRW million) | 34,167 | - | - | 43,261 | 62,761 |

| Dividends per share (KRW) | 417 | - | - | 528 | 767 | |

| Payout Ratio (%) |

133.3 | - | - | 18.0 | 20.1 | |

| Dividend yield (%) |

0.8 | - | - | 0.4 | 0.6 | |

| Share repurchases | Value of shares purchased (KRW million) | - | - | - | - | - |

Board of Directors

| Name | Position | Careers | Appointment | Term |

|---|---|---|---|---|

| Bang Jun Hyuk |

Chairman Inside Director |

2014~Present Chairman, Netmarble 2011~2014 Senior advisor in the Gaming Business, CJ ENM 2004~2006 President of the Business Strategy, CJ Internet 2003~2004 President of the Business Strategy, Plenus Entertainment 2000~2003 CEO, Netmarble |

Aug 01, 2014 | Mar, 2026 |

| Kim Byung Gyu |

CEO Inside Director |

2024~present CEO, Netmarble 2022~2024 Head of management planning, Netmarble 2018~2021 Head of risk management, Netmarble 2015~2017 Head of legal affairs, Netmarble 2011~2015 Legal Team, Samsung C&T 2009~2011 Sojong Partners |

Mar 28, 2024 | Mar, 2027 |

| Do Gi-Uk |

Inside Director |

2025~present Inside Director, Netmarble 2024~present Head of Financial Strategy, Netmarble 2023~2024 CEO, Netmarble 2022~2023 Executive officer, Netmarble 2017~2022 Head of Financial Strategy, Netmarble 2014~2016 Director of Finance in the Gaming Business Division, CJ ENM |

Mar 31, 2025 | Mar, 2028 |

| Li Nachuan |

Non- Executive Director |

2025~present Head of Business Development, Tencent Games 2022~2024 Vice General Manager of Business Development, Tencent Games 2020~2022 Assistant General Manager of Business Development, Tencent Games |

Mar 31, 2025 | Mar, 2028 |

| Lee Chan Hee |

Outside Director |

2022~Present Chairman, Samsung Compliance Committee 2022~Present Visiting Professor, Graduate School of Law, Seoul National University 2021~Present Standing Advisor, Yulchon LLC 2019~2021 50th President, Korean Bar Association 2017~2018 94th President, Seoul District Bar Association |

Mar 29, 2022 | Mar, 2028 |

| Yoon Dae Gyun |

Outside Director |

2016~Present Professor, Department of Software, Ajou University 2014~2015 Executive director, Samsung Electronics |

Mar 29, 2023 | Mar, 2026 |

| Lee Dong Heon |

Outside Director |

2017~Present Professor, Global Business College, Korea University Sejong Campus 2022~Present Planning director, Korean Association for Accounting |

Mar 29, 2023 | Mar, 2026 |

| Hwang Deuk Soo |

Outside Director |

2022~Present Director of business support in the entertainment sector, CJ ENM 2021~2022 Chief M&A Officer, CJ |

Mar 29, 2023 | Mar, 2026 |

| Kang Yi |

Outside Director |

2024~present CEO, LNK Tax and Accounting firm 2014~2023 Managing Director, Deloitte Anjin LLC 1999~2013 Tax office under Seoul Regional Tax Office |

Mar 31, 2025 | Mar, 2028 |

Subcommittee

| Category | Role | Members |

|---|---|---|

| Audit Committee | Performing auditing functions for the company's business, as well as overall accounting and duties performed by executives. | Lee Dong Heon(Subcommittee Chairman) Lee Chan Hee Yoon Dae Gyun Hwang Deuk Soo |

| Internal Transaction Committee | Review and approve transparency of internal transactions between related parties. | Hwang Deuk Soo(Subcommittee Chairman) Yoon Dae Gyun Lee Dong Heon |

| Compensation Committee | Increase transparency and ensure adequacy of executive compensation. | Lee Dong Heon |

| Outside Director Candidate Recommendation Committee | Selects candidates qualified to be outside directors and therefore recommends them as outside directors. | Yoon Dae Gyun(Subcommittee Chairman) Lee Chan Hee Hwang Deuk Soo |

| ESG Committee | Reviews and analyzes strategies and major matters concerning the Environment Social values and Corporate Governance | Lee Chan Hee(Subcommittee Chairman) Kim Byung Gyu |

CHAPTER I - GENERAL PROVISIONS

Article 1 (Corporate Name)(1) The name of this company shall be “Netmarble Chusik Hoesa” (the “Company”), which shall be “Netmarble Corporation” in English and simply Netmarble as abbreviation.

Article 2 (Objective)

The objective of the Company shall be to engage in the following business activities:

1. Holding of shares of its game-developing subsidiaries and management of such subsidiaries;

2. Investment and investment consulting;

3. Management consulting and financial consulting;

4. Lease and sale/purchase of real estate;

5. Internet related businesses;

6. Manufacture and sale of information and communication equipment;

7. Information and communication business;

8. Production and distribution of digital contents;

9. Entertainment related businesses;

10. Broadcast and media related businesses;

11. Production of game software;

12. Investment in movies and other motion pictures;

13. Distribution business and distribution agency business of movies and other motion pictures;

14. Import and export of movies and other motion pictures;

15. Production of games;

16. Wholesale, retail sale and distribution of motion pictures, albums, and games;

17. Distribution agency and rental business of motion pictures, albums, and games;

18. Distribution of copyright of contents;

19. Advertisement, marketing agency and publication;

20. Manufacturing, distributing and licensing of character merchandise

21. International trading (import and export) related to any of the foregoing businesses;

22. Development of software and contents;

23. Telemarketing business;

24. Wholesale and retail sale related to any of the foregoing businesses;

25. Recharging transportation cards and settlement of card use amount;

26. Business using data broadcasting channel;

27. Acquisition and ownership of shares or equity interests in companies closely related to the conduct of the foregoing businesses (“subsidiaries”), control or business administration and management of such subsidiaries, and other businesses incidental thereto as described below:

A. Business administration and management:

(1) Grant of business goals, and approval of business plans, of the subsidiaries, etc. (including the subsidiaries and second-tier subsidiaries and third-tier subsidiaries, same hereinafter);

(2) Evaluation of business performance of the subsidiaries, etc. and determination of compensation;

(3) Decisions on the management control structure of the subsidiaries, etc.;

(4) Inspection of the business and financial status of the subsidiaries, etc.; and

(5) Businesses incidental to subparagraphs (1) to (4) above.

B. Businesses supplemental to business administration and management:

(1) Funding for capital contribution to the subsidiaries or provision of other financial resources to the subsidiaries, etc.;

(2) Business support for development and sale of joint products with the subsidiaries, etc. and joint use of facilities and computer system with the subsidiaries, etc.; and

(3) Other businesses which do not require government licenses, approvals or permits under the applicable laws; and

28. Development and supply of products and services related to artificial intelligence (AI), virtual reality (VR), and augmented reality (AR)

29. Block chain related business and research and development

30. Production, distribution, sales, purchase of licenses, publishing, and projection of, music sources, movie, and animation

31. Services business related to sports and entertainment

32. Consultation service business

33. Any and all other businesses incidental to the foregoing

Article 3 (Head Office and Branches)

(1) The Company shall have its head office in Seoul.

(2) The Company may establish branches, liaison offices, representative offices or local subsidiaries within or outside Korea by resolutions of the Board of Directors, when it deems necessary.

Article 4 (Method of Public Notices)

Public notices of the Company shall be made in its website (http://company.netmarble.com); provided, however, that if such public notice in its website cannot be made for an unavoidable reason, the Company may make a public notice in “Hankook Kyongje Shinmoon,” a daily newspaper published in Seoul.

CHAPTER II - SHARES OF STOCK

Article 5 (Total Number of Authorized Shares)The total number of shares to be issued by the Company shall be 200,000,000 shares.

Article 6 (Par Value per Share)

The par value per share to be issued by the Company shall be one hundred (100) Won.

Article 7 (Total Number of Shares to Be Issued at the Time of Incorporation)

The Company shall issue 100,000 shares at the time of its incorporation.

Article 8 (Kind of Shares, and Types of Share Certificates)

The shares to be issued by the Company shall be common shares in registered form.

Article 9 (Electronic registration of the rights to be marked in the stocks and certificate of preemptive right to new stocks)

This company shall register the rights to be marked in the stocks and certificate of preemptive right to new stocks of electronic registration account book of the electronic registration institution instead of issuing stock certificates and certificate of preemptive right to new stocks.

Article 10 (Preemptive Rights)

(1) The issuance of new shares by the Company by a resolution of the Board of Directors shall be as follows:

1. By granting the existing shareholders an opportunity to subscribe for new shares to be issued by the Company in proportion to their respective shareholdings;

2. By granting certain persons (including the shareholders of the Company) an opportunity to subscribe for new shares to be issued by the Company, in a manner other than as set forth in subparagraph 1 above, as deemed necessary to achieve the Company’s management objectives (including, but not limited to, introduction of new technology and improvement of the financial structure of the Company), to the extent not exceeding 20% of the total issued and outstanding shares of the Company; and

3. By granting large numbers of unspecified persons (including the shareholders of the Company) an opportunity to subscribe for new shares to be issued by the Company, in a manner other than is set forth in subparagraph 1 above, to the extent not exceeding 30% of the total issued and outstanding shares of the Company, and allocating new shares to those of such persons who so subscribe.

(2) If new shares are allocated under subparagraph 3 of Paragraph (1) above, new shares shall be allocated by any of the following methods by a resolution of the Board of Directors:

1. Allocating new shares to large numbers of unspecified persons who subscribe, without classifying the types of persons who are granted an opportunity to subscribe for new shares to be issued by the Company;

2. Allocating new shares to members of the Employee Stock Ownership Association pursuant to applicable laws and granting large numbers of unspecified persons an opportunity to subscribe for new shares, including those which have not been subscribed;

3. Granting the existing shareholders an opportunity to preferentially subscribe for new shares to be issued by the Company and granting large numbers of unspecified persons an opportunity to be allocated new shares which have not been subscribed for; and

4. Granting certain types of persons an opportunity to subscribe for new shares to be issued by the Company, in accordance with reasonable standards set forth in applicable laws, such as demand forecasts prepared by an investment trader or investment broker as underwriter or arranger.

5. In case of issuing new stocks according to the issuance of depositary receipts(DR) with the resolution of the board of directors by the provisions of the related legislation like Capital Market and Financial Investment Services Act.

(3) In allocating new shares to persons other than the existing shareholders of the Company under subparagraph 2 of Paragraph (1) above, the Company shall give an individual notice to the shareholders or make a public notice, of the matters set forth in subparagraphs 1, 2, 2-2, 3 and 4 of Articles 416 of the Commercial Code, at least two (2) weeks prior to the due date for payment of subscription price for the new shares; provided, however, that in lieu of such individual notice or public notice, a report of material matters may be publicly disclosed to the Financial Services Commission and the Korea Exchange.

(4) In the event of issuance of new shares by any of methods set forth in Paragraph (1) above, the type and number of shares to be issued and the issue price shall be determined by a resolution of the Board of Directors.

(5) If the allocated new shares are not subscribed or paid for by the specific date, such shares shall be disposed of by a resolution of the Board of Directors with, taking into account the appropriateness of the issue price and other matters set forth in the relevant laws.

(6) Fractional shares, if any, resulting from the allocation of new shares shall be disposed of by a resolution of the Board of Directors.

Article 10-2 (Issuance Date of New Shares for the Purpose of Dividends)

In case the Company issues new shares through a rights offering, bonus issue or stock dividend, the new shares shall, for purposes of distribution of dividends on such new shares, be deemed to have been issued at the end of the fiscal year immediately prior to the fiscal year in which the new shares are issued.

Article 10-3 (Stock Options)

(1) The Company may grant stock options by a special resolution of the General Meeting of Shareholders, to the extent not exceeding 5% of the total number of issued and outstanding shares of the Company; provided, however, that by a resolution of the Board of Directors, stock options may be granted to persons other than Directors of the Company, to the extent not exceeding three (3) % of the total number of issued and outstanding shares. Any stock options granted by a resolution of the Board of Directors shall be approved in the first General Meeting of Shareholders convened after such grant. Stock options granted by a resolution of the General Meeting of Shareholders or a resolution of the Board of Directors may be a performance-tied type based upon management performance targets or market index.

(2) The persons who are entitled to receive stock options shall be persons who have contributed, or are capable of contributing, to the establishment, management, technological innovations or the like of the Company.

(3) The shares to be issued upon the exercise of a stock option (in case the Company pays the difference between the exercise price of stock options and the appraised value of such shares in cash or treasury shares, the shares which shall be the basis of the calculation of such difference) shall be common shares in registered form.

(4) The exercise price per share for the stock option shall be not less than the following prices. This shall also apply to the case of adjustment of exercise price after granting a stock option:

1. In the case of issuance and delivery of new shares, the higher of the price of the relevant stock appraised as of the date of granting stock options and the face amount of the relevant share; and

2. In the case of transfer of treasury shares, the price of the relevant stock appraised as of the date of granting stock options.

(5) In any of the following instances, the Company may, by a resolution of the Board of Directors, cancel stock options granted:

1. When the grantee voluntarily resigns from his or her position at the Company after receiving the stock option;

2. When the grantee incurs material damages or losses on the Company intentionally or negligently;

3. When the Company is unable to respond to the exercise of stock options due to its bankruptcy or dissolution; or

4. When the grantee fails to exercise the stock option within the exercise period; or

5. When there occurs any other event for cancellation of the stock option pursuant to the stock option agreement.

(6) The Company may grant stock options in any of the following methods:

1. Issue and deliver new shares which shall be common shares in registered form, at the exercise price of stock options;

2. Pay cash or deliver treasury shares for the difference between the exercise price of the stock option and the market price of such shares (multiplied by the number of exercised options); or

3. Deliver treasury shares which shall be common shares in registered form, at the exercise price of stock options.

(7) A person who is granted stock options may only exercise such stock options if such person has served the Company for two (2) or more years following the date of the resolution of the General Meeting of Shareholders as provided in Paragraph (1) above (the “Stock Option Resolution Date”). Such person may exercise the stock options during the exercise period set forth in the relevant stock option agreement between such person and the Company, which period shall fall within five (5) years from the date on which such person has served the Company for two (2) or more years following the Stock Option Resolution Date; provided, however, that such person may exercise the stock options during the exercise period thereof even if, within two (2) years following the Stock Option Resolution Date, such person dies or resigns for reasons not attributable to such person.

(8) With respect to the dividend on the new shares issued by exercise of stock options, the provisions of Article 10-2 hereof shall apply mutatis mutandis.

Article 11 (Transfer Agent)

(1) The Company shall have a transfer agent for its shares.

(2) The transfer agent, its office and the scope of its duties shall be determined by a resolution of the Board of Directors.

(3) The company shall furnish the list of stockholders and the copy of this company in the office handling place and render the title transfer proxy to deal with the electronic registration of stocks, the management of the list of stockholders, or other office as to stocks.

(4) Procedures for the handling of office affairs of paragraph 3 shall be in accordance with the relevant work regulation set by a transfer agent.

Article 12 (Preparation and display of the shareholder register)

(1) Upon notification of the owner’s detail from the electronic registration institution, the Company shall record the details and the year and date of notification in the shareholder register and display the register.

(2) The Company may request for recording owner’s detail to the electronic registration institution to identify the share ownership status.

Article 13 (Reference date)

(1) Upon notification of the owner’s detail from the electronic registration institution, the Company shall record the details and the year and date of notification in the shareholder register and display the register.

(2) The Company may request for recording owner’s detail to the electronic registration institution to identify the share ownership status.

CHAPTER III - BONDS

Article 14 (Issuance of Bonds)(1) The Company may issue bonds by a resolution of the Board of Directors.

(2) Notwithstanding Paragraph (1) above, the Board of Directors may delegate to the Chief Executive Officer the issuance of bonds within a period not exceeding one (1) year, by designating the amount and types of the bonds to be issued.

Article 14-2 (Issuance and Allocation of Convertible Bonds)

(1) The Company may, in any of the following cases, issue convertible bonds to persons other than existing shareholders of the Company, by a resolution of the Board of Directors:

1. If, by a method other than that specified in subparagraph 1 of Article 10(1) above, the Company issues convertible bonds, to the extent that the total par value of the bonds shall not exceed KRW 500 billion, by granting certain persons (including the shareholders of the Company) an opportunity to subscribe for convertible bonds to be issued by the Company, as deemed necessary to achieve the Company’s management objectives (including, but not limited to, introduction of new technology and improvement of the financial structure of the Company); or

2. If, by a method other than that specified in subparagraph 1 of Article 10(1) above, the Company issues convertible bonds, to the extent that the total par value of the bonds shall not exceed KRW 500 billion, by granting large numbers of unspecified persons (including the shareholders of the Company) an opportunity to subscribe for bonds to be issued by the Company and allocating convertible bonds to those of such persons who so subscribe.

(2) If bonds are allocated under subparagraph 2 of Paragraph (1) above, bonds shall be allocated by any of the following methods by a resolution of the Board of Directors:

1. Allocating convertible bonds to large numbers of unspecified persons who subscribe, without classifying the types of persons who are granted an opportunity to subscribe for bonds to be issued by the Company;

2. Granting the existing shareholders an opportunity to preferentially subscribe for convertible bonds to be issued by the Company and granting large numbers of unspecified persons an opportunity to be allocated convertible bonds which have not been subscribed for; and

3. Granting certain types of persons an opportunity to subscribe for convertible bonds to be issued by the Company, in accordance with reasonable standards set forth in applicable laws, such as demand forecasts prepared by an investment trader or investment broker as underwriter or arranger.

(3) The Board of Directors may cause the convertible bonds referred to in Paragraph (1) above to be issued on the condition that conversion rights will be attached to only a portion of the convertible bonds.

(4) The shares to be issued upon conversion shall be common shares in registered form, and the conversion price, which shall be equal to or more than the par value of the shares, shall be determined by the Board of Directors at the time of issuance of the convertible bonds.

(5) The conversion period shall commence on the date on which one (1) month has passed since the issue date of the convertible bonds and end on the date immediately preceding the redemption date thereof. However, the conversion period may be adjusted within the above period by a resolution of the Board of Directors.

(6) For the purpose of any distribution of dividends on the shares issued upon conversion, and any payment of accrued interest on the convertible bonds, Article 10-2 hereof shall apply mutatis mutandis.

(7) The minimum conversion price as adjusted after a market price decrease may, by a special resolution of the General Meeting of Shareholders, be determined by the Company at a level lower than 70% of the conversion price in effect as of the issuance of the convertible bonds.

Article 15 (Issuance and Allocation of Bonds with Warrants)

(1) The Company may, in any of the following cases, issue bonds with warrants to persons other than existing shareholders of the Company, by a resolution of the Board of Directors, to the extent that the total par value of the bonds shall not exceed KRW 1 trillion;

1. If, by a by a method other than that specified in subparagraph 1 of Article 10(1) above, the Company issues bonds with warrants, to the extent that the total par value of the bonds shall not exceed KRW 500 billion, by granting certain persons (including the shareholders of the Company) an opportunity to subscribe for bonds with warrants to be issued by the Company, as deemed necessary to achieve the Company’s management objectives (including, but not limited to, introduction of new technology and improvement of the financial structure of the Company); or

2. If, by a method other than that specified in subparagraph 1 of Article 10(1) above, the Company issues bonds with warrants, to the extent that the total par value of the bonds shall not exceed KRW 500 billion, by granting large numbers of unspecified persons an opportunity to subscribe for bonds to be issued by the Company and allocating bonds with warrants to those of such persons who so subscribe.

(2) If bonds with warrants are allocated under subparagraph 2 of Paragraph (1) above, bonds shall be allocated by any of the following methods by a resolution of the Board of Directors:

1. Allocating bonds with warrants to large numbers of unspecified persons who subscribe, without classifying the types of persons who are granted an opportunity to subscribe for bonds to be issued by the Company;

2. Granting the existing shareholders an opportunity to preferentially subscribe for bonds with warrants to be issued by the Company and granting large numbers of unspecified persons an opportunity to be allocated bonds with warrants which have not been subscribed for; and

3. Granting certain types of persons an opportunity to subscribe for bonds with warrants to be issued by the Company, in accordance with reasonable standards set forth in applicable laws, such as demand forecasts prepared by an investment trader or investment broker as underwriter or arranger.

(3) The amount of new shares which can be subscribed for by the holders of the bonds with warrants shall be determined by the Board of Directors, to the extent that the amount of such new shares shall not exceed the total par value of the bonds with warrants.

(4) The shares to be issued upon exercise of warrants shall be common shares in registered form, and the issue price, which shall be equal to or more than the par value of the shares, shall be determined by the Board of Directors at the time of issuance of bonds with warrants.

(5) The period during which the warrants may be exercised shall commence on the date on which one (1) month has passed since the issue date of the bonds with warrants and end on the date immediately preceding the redemption date thereof. However, the period during which the warrants may be exercised may be adjusted within the above period by a resolution of the Board of Directors.

(6) For the purpose of any distribution of dividends on the shares issued upon exercise of warrants, Article 10-2 hereof shall apply mutatis mutandis.

(7) The minimum warrant exercise price as adjusted after a market price decrease may, by a special resolution of the General Meeting of Shareholders, be determined by the Company at a level lower than 70% of the warrant exercise price in effect as of the issuance of the bonds with warrants.

Article 15-2 (Electronic registration of the rights to be marked in the debentures and policy of preemptive right to new stocks)

This company shall register the rights to be marked in the debentures and policy of preemptive right to new stocks of electronic registration account book of the electronic registration institution instead of issuing debentures and policy of preemptive right to new stocks.

Article 16 (Applicable Provisions for the Issuance of Bonds)

The provisions of Articles 11 hereof shall apply to the issuance of bonds mutatis mutandis.

CHAPTER IV - GENERAL MEETINGS OF SHAREHOLDERS

Article 17 (Convening of General Meetings of Shareholders)(1) General Meetings of Shareholders of the Company shall be of two types: (i) Ordinary and (ii) Extraordinary.

(2) The Ordinary General Meeting of Shareholders shall be held within three (3) months after the end of each fiscal year and the Extraordinary General Meeting of Shareholders may be convened whenever deemed necessary.

Article 18 (Authority to Convene)

(1) The Chief Executive Officer of the Company or other person designated by the Board of Directors, if any, shall convene the General Meeting of Shareholders in accordance with a resolution of the Board of Directors, unless otherwise prescribed by the applicable laws and regulations.

(2) If the Chief Executive Officer is absent or unable to perform his/her duties, Article 34(2) below shall apply mutatis mutandis.

Article 19 (Personal or Public Notices of Convocation)

(1) A convocation notice of the General Meeting of Shareholders of the Company stating the date, time and place of the Meeting and the purposes for which the Meeting has been convened shall be sent, in writing or in electronic form, to all shareholders at least two (2) weeks prior to the date set for such Meeting.

(2) A convocation notice of the General Meeting of Shareholders to the shareholders holding shares one-hundredth (1/100) or less of the total number of voting shares of the Company may be deemed to be made under Paragraph (1) above by (i) inserting two (2) or more public notices in Hankook Kyongje Shinmoon and Maeil Kyongje Shinmoon circulated in Seoul, or (ii) making a public notice on the Data Analysis, Retrieval and Transfer System operated by the Financial Supervisory Service or the Korea Exchange.

Article 20 (Place of Meeting)

The General Meeting of Shareholders shall be held in the city where the head office of the Company is located or any other place adjacent thereto as necessary.

Article 21 (Chairman of the General Meeting of Shareholders)

(1) The Chief Executive Officer shall be the Chairman of the General Meetings of Shareholders.

(2) If the Chief Executive Officer is absent or unable to perform his/her duties, the Chairman shall be appointed by a resolution of the Board of Directors.

Article 22 (Chairman’s Authority to Maintain Order)

(1) The Chairman of the General Meeting of Shareholders may order persons who purposely speaks or acts in a manner that prevents or disrupts the deliberations of the General Meeting of Shareholders or who otherwise disturb the public order of the General Meeting of Shareholders to stop their remarks or to leave the place of meeting. The persons so ordered shall comply with the order.

(2) The Chairman may restrict the length and frequency of the speech of shareholders if it is necessary for the smooth deliberations of the General Meeting of Shareholders.

Article 23 (Voting Rights)

Each shareholder shall have one (1) vote for each share he/she/it owns.

Article 24 (Limitation to Voting Rights of Cross-Held Shares)

If the Company, its parent company or any of its subsidiaries, alone or in aggregate, hold shares exceeding ten (10) % of the total number of issued and outstanding shares of another company, the shares of the Company held by such other company shall not have voting rights.

Article 25 (Split Voting)

(1) If any shareholder who holds two (2) or more votes wishes to split his/her/its votes, he/she/it shall notify the Company, in writing or in electronic document, of such intent and the reasons therefor no later than three (3) days prior to the date set for the General Meeting of Shareholders.

(2) The Company may refuse to allow the shareholder to split his/her/its votes, unless the shareholder acquired the shares in trust or otherwise holds the shares for and on behalf of some other person.

Article 26 (Voting by Proxy)

(1) A shareholder may exercise his/her/its vote through a proxy.

(2) A proxy holder under Paragraph (1) above shall file with the Company documents (power of attorney) evidencing the authority to act as a proxy prior to the commencement of the General Meeting of Shareholders.

Article 27 (Method of Resolution)

Except as otherwise provided in the applicable laws and regulations, all resolutions of the General Meeting of Shareholders shall be adopted by the affirmative vote of a majority of the shareholders present; provided that such votes shall, in any event, represent not less than one-fourth (1/4) of the total number of issued and outstanding shares of the Company.

Article 28 (Minutes of the General Meetings of Shareholders)

The substance of the course of the proceedings of the General Meeting of Shareholders and the results thereof shall be recorded in the minutes and such minutes shall be kept at the head office and branches of the Company.

CHAPTER V - DIRECTORS, BOARD OF DIRECTORS AND STATUTORY AUDITORS

Article 29 (Number of Directors)(1) The directors of this company shall be more than 3 and less than 10.

(2) The board of directors of this Company not be composed only of directors with a specific gender.

Article 30 (Appointment of Directors)

(1) The Directors shall be elected at the General Meeting of Shareholders.

(2) In electing two or more Directors, the cumulative voting as prescribed by Article 382-2 of the Commercial Act shall not apply.

Article 30-2 (Recommendation of Candidates for Outside Directors)

(1) Candidates for outside Directors shall be recommended by the Outside Director Candidate Recommendation Committee from among persons meeting the qualification requirements under the Commercial Code and other relevant laws.

(2) Detailed matters regarding the recommendation of candidates for outside Directors and examination of their qualifications shall be determined by the Outside Director Candidate Recommendation Committee.

Article 31 (Term of Director)

The term of office for the Director shall be until the close of the Ordinary General Meeting of Shareholders convened in respect of the 3rd fiscal year after the date of appointment of such Director.

Article 32 (By election of Directors)

(1) In the event of any interim vacancy in the office of any Director, a substitute Director shall be elected in a General Meeting of Shareholders; provided, however, that the foregoing shall not apply if the number of the remaining Directors satisfies the required number of Directors and such vacancy does not cause any difficulties in the business operation of the Company.

(2) If, due to the resignation or death of an outside Director or a similar cause, the required number of Directors under Article 29 above is not satisfied, such required number shall be satisfied in the first General Meeting of Shareholders convened after the occurrence of such cause.

Article 33 (Chief Executive Officer)

The Company may appoint the Chief Executive Officer, among directors, the number of which shall be one or more, by the resolution of the board of directors. In case where the number of Chief Executive Officer is two or more, the they shall represent the company respectively.

Article 34 (Duties of Directors)

(1) The Chief Executive Officer shall represent the Company and take overall charge of the business operation of the Company.

(2) In case of accident of the Chief Executive Officer, a person by the order determined by the board of directors or separately determined by the board of directors shall act on behalf of the Chief Executive Officer.

(3) The Chief Executive Officer of the Company shall report the status of their respective business performance to the Board of Directors at least once every three (3) months.

Article 34-2 (Release of Liability of Directors)

The Company may, by the resolution of the general meeting of shareholders, absolve the director under Article 399 from liability with respect to the amount exceeding six times (in cases of outside directors, three times) his/her remuneration (including bonuses and the profit from exercise of stock option) for the last one year prior to the date of the act or misconduct by the director: Provided, That this shall not apply where the director has incurred any loss or damage by intention or gross negligence and he/she falls under Article 397, 397-2 or 398.

Article 34-3 (Director’s Obligation to Report)

If any Director finds any fact which may cause substantial damage to the Company, such Director shall promptly report such to the Audit Committee.

Article 35 (Board of Directors)

The Board of Directors shall consist of Directors and resolve important matters regarding the business affairs of the Company as set forth in the applicable laws and regulations, these Articles of Incorporation or the Board of Directors Regulations.

Article 36 (Chairman of the Board of Directors)

(1) The Chairman of the Board of Directors shall be elected by the Board of Directors from among the Directors.

(2) If the Chairman is absent or unable to perform his/her duties, the chairmanship shall be performed by other persons in the order of priority determined by the Board of Directors.

Article 37 (Convening of the Meeting of Board of Directors)

(1) A meeting of the Board of Directors shall be convened by the Chairman of the Board of Directors, who shall give each Director a written or oral notice of such meeting at least five (5) business days prior to the date set for such meeting; provided, however, that such convocation procedure may be omitted with the unanimous consent of all Directors.

(2) Each Director may request the Chairman of the Board of Directors to convene a meeting of the Board of Directors, if deemed necessary for the performance of duties as Director. In such case, the Chairman of the Board of Directors shall immediately convene a Board of Directors meeting pursuant to Paragraph (1) above.

Article 38 (Method of Resolution)

(1) Except as otherwise provided in the applicable laws and regulations or these Articles of Incorporation, all resolutions of a Board of Directors meeting shall be adopted by the affirmative vote of more than one-half (1/2) of the Directors present at such meeting where more than one-half (1/2) of the total number of Directors are present.

(2) Any Director who has a particular interest in the matters to be resolved at a meeting of the Board of Directors shall not be entitled to vote at such meeting.

(3) The Board of Directors may allow all or part of the Directors to participate, without being actually present at a Board of Directors meeting, in the resolution of such Board of Directors’ meeting, by means of a communication system whereby they may receive and transmit live audio communications. Directors participating in a Board of Directors meeting in such manner shall be deemed to be present in person at such meeting.

Article 39 (Non-Compete Obligation of Directors)

No Director may be engaged in the same kind of business activities as the Company, without the approval of the Board of Directors.

Article 40 (Minutes of Board of Directors Meetings)

The agenda, proceedings and results of any Board of Directors meeting shall be recorded in the minutes, which shall be affixed with the names and seal impressions or signatures of the Chairman and the Directors present thereat.

Article 40-2 (Committees)

(1) The Company may have the following committees within the Board of Directors:

1. Outside Director Candidate Recommendation Committee;

2. Audit Committee;

3. Inside Trading Committee;

4. Compensation Committee;

5. ESG Committee; and

6. Other committees as deemed necessary by the Board of Directors.

(2) The composition, powers, operation, etc. of each of the committees within the Board of Directors shall be determined by a resolution of the Board of Directors.

(3) The provisions of Articles 37, 38 and 40 hereof shall apply mutatis mutandis with respect to committees within the Board of Directors.

Article 41 (Composition of Audit Committee)

(1) The Company shall have an Audit Committee under Article 40-2 hereof (the “Audit Committee”) in lieu of statutory auditors.

(2) The Audit Committee shall consist of three (3) or more Directors.

(3) Two-thirds (2/3) or more of the members of the Audit Committee shall be outside Directors, and the requirements under Article 542-10(2) of the Commercial Code shall be satisfied with respect to any member of the Audit Committee who is not an outside Director.

(4) The members of the audit committee shall be appointed from among directors appointed at a general meeting of shareholders. Provided, however, one member of the audit committee shall be appointed from a director independent from other directors by a resolution of the general meeting of shareholders.

(5) The appointment of the members of the audit committee shall be made effective by affirmative votes of a majority of shareholders present at a general meeting, which must be equal to at least one-fourth of the total outstanding shares. Provided, however, when a shareholder may exercise an absentee vote by electronic means in accordance with Article 368-4 (1) of Commercial Act, despite the former part, the appointment of the member of the audit committee may be resolved by votes of a majority of shareholders present at a general meeting.

(6) The members of the audit committee may be dismissed by a resolution of the general meeting of shareholders in accordance with Article 434 of Commercial Act. In such a case, the member of the audit committee pursuant to proviso to paragraph 4 will lose all position and status as a director and a member of the audit committee.

(7) When voting to elect or remove audit committee members, shareholders (when the largest shareholder is electing or dismissing members of the audit committee other than outside directors, shares owned by his/her specially related person or other person stipulated by Enforcement Decree of the Commercial Act shall be aggregated) who hold stocks exceeding three percent of the total number of issued and outstanding shares other than nonvoting stocks shall be prohibited from exercising their voting rights on the stocks held in excess.

(8) The Audit Committee shall, by its resolution, select a person (chairman) who will represent the Audit Committee, and such chairman shall be an outside Director.

(9) If the number of outside directors owing to the reason of the resignation, death etc. of the outside directors who are the committee of Audit Committee falls short of the composition requirements of Audit Committee specified in this Article, the company shall conform to the requirement in the general meeting of stockholders convened first after the reason occurs.

Article 41-2 (Duties of the Audit Committee)

(1) The Audit Committee shall examine the operation and accounting of the Company.

(2) The Audit Committee may, if necessary, request the convening of a meeting of the Board of Directors by submitting, to a Director (or a person, if any, who has the authority to convene a Board of Directors meeting; same hereinafter), documents stating the agenda and reasons for convening such meeting.

(3) If, despite the request under Paragraph (2) above, a Board of Directors meeting is not promptly convened by the relevant Director, the Audit Committee that made such request may convene a Board of Directors meeting.

(4) The Audit Committee may request the Board of Directors to convene an Extraordinary General Meeting of Shareholders by submitting documents stating the agenda and reasons for convening such meeting.

(5) The Audit Committee may request business reports from any subsidiary of the Company if it is necessary for performing his or her duties. In this case, if such subsidiary does not report to the Audit Committee immediately or the Audit Committee needs to verify the content of such report, the Audit Committee may investigate the status of business and financial condition of such subsidiary.

(6) The Audit Committee shall appoint external auditors.

(7) In addition to the matters referred to in Paragraphs (1) through (6) above, the Audit Committee shall carry out the matters delegated by the Board of Directors.

(8) No matters resolved by the Audit Committee may be resolved again by the Board of Directors.

(9) The Audit Committee may, at the expenses of the Company, seek the assistance of experts.

Article 41-3 (Auditor’s Record)

For the audit performed by the Audit Committee, the Audit Committee shall prepare an auditor’s record, which shall record the substance and results of the audit and shall be affixed with the names and seal impressions or signatures of the Audit Committee members who have performed such audit.

Article 42 (Remuneration and Severance Pay for Directors)

(1) The remuneration for the Directors shall be determined by a resolution of the General Meeting of Shareholders.

(2) The payment of severance pay for the Directors shall be in accordance with the “Regulations on Severance Pay for Officers”, which has been approved at the General Meeting of Shareholders.

CHAPTER VI - ACCOUNTING

Article 43 (Fiscal Year)The fiscal year of the Company shall begin on January 1 of each year and end on December 31 of such year.

Article 44 (Preparation, etc. of Financial Statements, etc.)

(1) The Chief Executive Officer of the Company shall prepare the documents set forth in Articles 447 and 447-2 of the Commercial Code, which shall be approved by the Board of Directors.

(2) The Chief Executive Officer shall submit the documents set forth in Paragraph (1) above to the Audit Committee no later than six (6) weeks prior to the date of the Ordinary General Meeting of Shareholders.

(3) The Audit Committee shall submit an audit report to the Chief Executive Officer at least one (1) week prior to the date of the Ordinary General Meeting of Shareholders.

(4) The Chief Executive Officer shall keep on file the documents described in Paragraph (1) above, together with an audit report thereon, at the head office of the Company for five (5) years, and certified copies thereof at the branches of the Company for three (3) years, beginning from one (1) week prior to the date of the Ordinary General Meeting of Shareholders.

(5) The Chief Executive Officer shall submit the documents set forth in Article 447 of the Commercial Code to the Ordinary General Meeting of Shareholders for approval and submit and report the documents set forth in Article 447-2 of the Commercial Code to the Ordinary General Meeting of Shareholders.

(6) Notwithstanding Paragraph (5) above, the Company may approve the documents set forth in Article 447 of the Commercial Code, by a resolution of the Board of Directors, if (i) the external auditor gives the opinion that the documents set forth in Article 447 of the Commercial Code appropriately present the financial position and management performance of the Company pursuant to the applicable laws and regulations and these Articles of Incorporation and (ii) all of the members of the Audit Committee agree.

(7) In the event the Board of Directors has approved the above documents in accordance with Paragraph (6) above, the Chief Executive Officer shall report the terms of each of the documents to the General Meeting of Shareholders.

(8) Immediately upon obtaining the approval under Paragraphs (5) or (6) above, the Chief Executive Officer shall make a public notice of the balance sheet and audit opinion of the external auditor.

Article 44-2 (Appointment of External Auditor)

The Company shall appoint the outside auditor selected by Audit Committee according to the provisions of Act on External Audit of Corporation, and report the fact to a regular general meeting of stockholders convened during the business year of the appointment or notify or announce it to the stockholders according to the decision in the Act on External Audit of Corporation Enforcement Ordinance.

Article 45 (Distribution of Profits)

The Company shall distribute any unappropriated retained earnings as of the end of each fiscal year, as follows:

1. earned surplus reserves;

2. other statutory reserves;

3. dividends;

4. temporary reserves; and

5. other appropriation of earned surplus.

Article 46 (Dividends)

(1) Dividends may be distributed in cash or stock.

(2) The company may make quarterly dividends in cash by the resolution of the board of directors within 45 days from the end of March, June and September after the commencement date of the financial year, and shall pay such dividends within 30 days from the above resolution date.

(3) The company may set a record date by the resolution of the Board of Directors for determining shareholders that dividends are paid to under Paragraphs 1 and 2, and, if the company determines the record date, it shall give a public notice two weeks prior to such date.

(4) In cases of issuing new shares before each record date determined in the Board of Directors pursuant to Paragraph 3 for quarterly dividend payment after the commencement of the financial year (including cases of capitalization of reserves, share dividends, demand for conversion of convertible bonds, and exercising warrant rights of bonds with warrants), the new shares shall be considered as having been issued in the end of the immediately preceding financial year with respect to such quarterly dividends.

(5) The company shall not pay the interest as to the stockholder's dividend.

Article 47 (Expiration of Right to Payment of Dividends)

(1) The right to demand payment of dividends shall extinguish by prescription unless exercised within five (5) years.

(2) The dividends of which the right has been extinguished under Paragraph (1) above shall be kept by the Company.

ADDENDA

Article 1 (Establishment of Company through Spin-Off and Effective Date)The Company shall be established through a spin-off of CJ E&M Corporation, and these Articles of Incorporation shall become effective from the date of incorporation of the Company.

Article 2 (Special Exception to Fiscal Year)

The initial fiscal year of the Company shall be until December 31 of 2011, notwithstanding the provisions of Article 43 above.

ADDENDUM

These Articles of Incorporation shall become effective from March 28, 2013.ADDENDUM

These Articles of Incorporation shall become effective from March 21, 2014.ADDENDUM

These Articles of Incorporation shall become effective from June 30, 2014.ADDENDUM

These Articles of Incorporation shall become effective from August 26, 2014.ADDENDUM

(Effective Date) These Articles of Incorporation shall become effective from the date immediately following the date of expiration of the public notice of submission of stock certificates under a stock split (February 24, 2015)ADDENDUM

These Articles of Incorporation shall become effective from March 27, 2015.ADDENDUM

These Articles of Incorporation shall become effective from March 31, 2016.ADDENDA

Article 1 (Effective Date)These Articles of Incorporation shall become effective from September 23, 2016.

Article 2 (Special Exception Provisions for Listed Companies)

Special exception provisions for listed companies under relevant laws shall become effective upon listing of the Company on the stock market.

ADDENDUM

These Articles of Incorporation shall become effective from October 31, 2016.ADDENDUM

These Articles of Incorporation shall become effective from March 30, 2018.ADDENDUM

These Articles of Incorporation shall be effective from March 29, 2019. However, the amended content of Article 9, Article 11, Article 15-2, Article 16 etc. shall be in the force and effect from Sept. 16, 2019 [The Enforcement Decree of the Act on the electronic registration of stocks, bonds, etc.] is executed.ADDENDUM

These Articles of Incorporation shall become effective from March 26, 2021.ADDENDUM

These Articles of Incorporation shall become effective from March 29, 2023.ADDENDUM

These Articles of Incorporation shall become effective from March 28, 2024.ADDENDUM

These Articles of Incorporation shall become effective from March 31, 2025.Independent Auditor

| Year of Audit | Accounting Standard | Auditor | Auditor’s Opinion |

|---|---|---|---|

| 2024 (14th period) |

K-IFRS | Deloitte Anjin LLC | Unqualified |

| 2023 (13th period) |

K-IFRS | Deloitte Anjin LLC | Unqualified |

| 2022 (12th period) |

K-IFRS | Deloitte Anjin LLC | Unqualified |

| 2021 (11th period) |

K-IFRS | Deloitte Anjin LLC | Unqualified |

| 2020 (10th period) |

K-IFRS | Deloitte Anjin LLC | Unqualified |

| 2019 (9th period) |

K-IFRS | Deloitte Anjin LLC | Unqualified |

| 2018 (8th period) |

K-IFRS | Deloitte Anjin LLC | Unqualified |

| 2017 (7th period) |

K-IFRS | Samjong KPMG Inc. | Unqualified |

| 2016 (6th period) |

K-IFRS | Samjong KPMG Inc. | Unqualified |

| 2015 (5th period) |

K-IFRS | Samjong KPMG Inc. | Unqualified |

| 2014 (4th period) |

K-IFRS | Samjong KPMG Inc. | Unqualified |